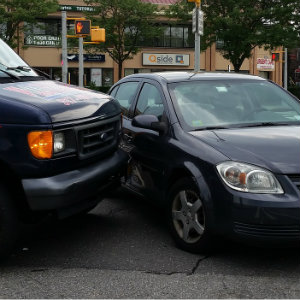

How Will My Insurance Handle Uninsured Drivers?

If you’ve recently been in an accident with an uninsured driver, you may be wondering about your rights. Dealing with the various consequences of a car accident is stressful enough, and finding out the other driver is uninsured adds another layer to this stress.

Uninsured Motorist Coverage

In Pennsylvania, insurance companies offer an option for uninsured motorist coverage. Drivers with this coverage will receive some compensation from their insurance companies in the event of an accident with an uninsured driver. But just like liability insurance, there are caps for these payouts. Your insurance company will pay for damages up to the limit you’ve purchased with your plan.

What If I Don’t Have Uninsured Motorist Coverage?

Dealing with the aftermath of an accident will be especially difficult if your plan doesn’t have these protections. In these situations, it’s time to consider seeking financial compensation in civil court. However, the unfortunate reality is that many uninsured drivers are uninsured simply because they can’t afford it. With these individuals, it may be difficult to collect the compensation you need during your recovery.

What If My Coverage Doesn’t Cover My Expenses?

Even if you have this coverage, you may find that your plan limit does not fully cover the various expenses you’re dealing with in the aftermath of your accident. Accident victims are forced to take on a variety of financial burdens, which may include:

- Medical bills

- Lost wages and earning potential

- Loss of quality of life

- Pain and suffering

In many cases, your insurance plan will only be able to cover a portion of your medical bills. This leaves you alone to deal with the various other financial setbacks in the wake of your accident. However, there are situations in which civil recourse may be possible.

Suing Uninsured Motorists

Suing an uninsured motorist will often be an uphill battle. Even if the court rules in your favor and awards compensation, collecting those funds may prove difficult. It depends on the reason that the other driver chose to drive uninsured. If he or she is living in poverty and needed to drive but couldn’t afford insurance, your odds of receiving payment may be low. But in these circumstances, the court may institute a payment plan for your damages.

However, other uninsured drivers may have chosen to drive uninsured, even though they do have the financial means to afford a plan.

Is This Coverage Necessary?

Yes. Even though there’s no law requiring it, responsible drivers should make sure to have coverage against uninsured motorists. The small increase in your monthly premium is well worth the coverage you’ll receive in these unfortunate circumstances. With roughly 1 in 8 drivers being uninsured, it’s simply not worth the risk of trying to seek financial compensation from an uninsured driver.

Related Pages